GET A PIECE OF LE SARYU PRIVATE LIMITED

LE SARYU PRIVATE LIMITED

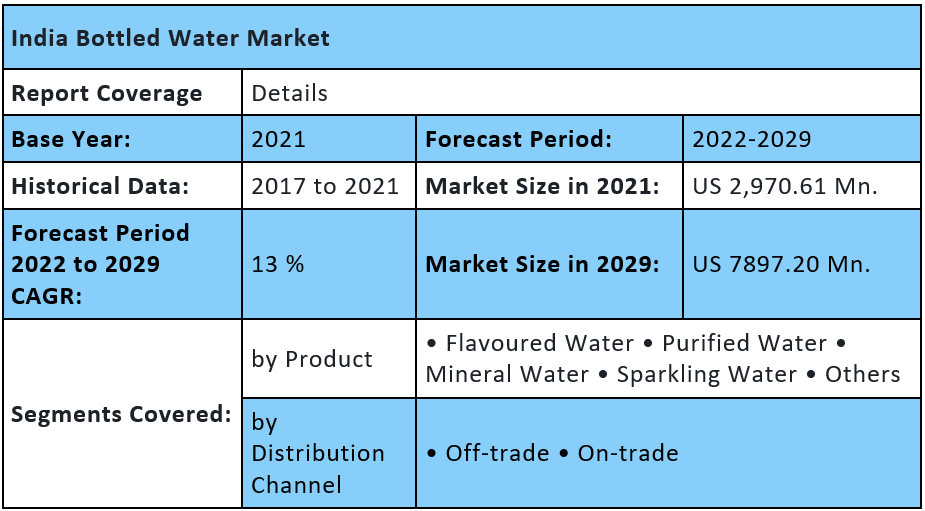

India Bottled Water Market was valued at USD 2,970.61 Million in 2021, and it is expected to reach USD 7897.20 Million by 2029, exhibiting a CAGR of 13% during the forecast period (2022-2029).

This Reg CF offering is made available through Private Equity Junction. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

REASONS TO INVEST

With inauguration of the Ram Temple by PM recently there has been a meteoric rise in demand for bottled drinking water with the arrival of 300,000 visitors per day to Ayodhya, the erstwhile little known sleepy temple town.

The Saryu River water is highly polluted and as such not potable, infact not even recommended for bathing – Thereby waters shortages in Ayodhya.

There are only two other bottled water manufacturers in Ayodhya. Hence, no competition. Good distribution system to secure the small town of Ayodhya, thus reaching out to market easy. Guaranteed returns.

Take a piece of Le Saryu the bottled drinking water brand that is to take Ayodhya by storm. With the slated 300,000 visitors arriving into this newly inaugurated Temple City, the birth place of Lord Rama, Ayodhya has never had it so good with a booming business and a meteoric rise in investments returns!

While the government of Uttar Pradesh has developed conducive investment policy packages and other sectoral reforms both at the State level as well as the District level Ayodhya is undergoing development with the Ayodhya Master Plan 2031. The plan includes an investment of Rs 85,000, on a 30 sq km stretch on the banks of the holy Saryu river, to meet the requirement of a daily footfall of around 3 lakhs.

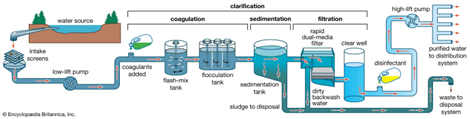

It is in keeping with this that Le Sarayu, the branded bottled drinking water brand has taken an advance action to meet this emerging challenge of a geometrical growth in demand for bottled drinking water in Ayodhya by creating a matching production capacity of highly purified bottled mineral water. More specifically the project is intended to:

- Exploit ground water resources for commercial bottling purpose

- Produce highly purified bottle water to the ideal capacity of the factory and thereby it could be possible to satisfy the demand of local and international market (for the future)

- Employ highly advanced technology and machinery

- Create Job opportunities to the local population and the community

- Generate revenue to the Government in the form of taxes and

- Last but not the least to earn reasonable profit from the investment.

To establish bottled mineral water production plant in Ayodhya to provide high quality and original bottled water. The proposed product line will consist of bottles of 200 ML 300ML, 500 ML, 1 L and 2 Liters. In the initial phase of the project only 200 ML, 300ML, 500 ML and 1 Litre bottles will be introduced in the market. After successful introduction of new brand of bottled water the product category may be fulfill the rest 2 Litres in keeping with the customers demand.

The market for bottled water has seen a steady growth in India over the years. The Bottled water market in India symbolizes a new lifestyle and increasing health consciousness. With a growth of 40-45% over the last five years, bottled drinking water today is a billion dollar industry.

The Indian bottled water market, valued at US$ 2.9 Billion in 2021 is slated to grow at a rate of 13% per annum to touch US$ 7.9 billion by 2029.

The Le Sarayu project is slated to bottle 60,000 liters of water per day, in bottles of different sizes in keeping with the consumer demand. This will soon be doubled to touch 120,000 Litres per day to match up to the growing demand in keeping with visitors inflow into the tiny Temple City.

The plant will be set up right in the centre of Ayodhya city in the old industrial area, giving it a huge economic advantage in terms of logistic costs as compared to other new projects to be established 30 kms outside the City in new upcoming industrial areas where transportation cost alone will out price their bottled water.

The project is to be located in Gaddaopur Industrial Estate Ayodhya, Ayodhya District, in the State of Uttar Pradesh. The nearest City is FAIZABAD, just about 7 km from Ayodhya and known for its architectural heritage and boasts of structures like the Faizabad Clock Tower and the Gulab Bari. Ayodhya has been transformed by the Central Government with the building of the new RAM Temple and its inauguration on January 21, 2024.

Ayodhya today is one of the most advanced cities in India with the building of one of the biggest airports, new Railway Station, Bus Station, launching of new modern trains and linking Ayodhya to the length and breadth of the country. This has led to the constant flow of visitors from, all over the country, which is to estimated at 200,000 people every single day.

Past Supply and Present Demand

India Bottled Water Market was valued at USD 2,970.61 Million in 2021, and it is expected to reach USD 7897.20 Million by 2029, exhibiting a CAGR of 13% during the forecast period (2022-2029).

India Bottled Water Market Overview

Bottled water market is a symbol of a new lifestyle and health-consciousness rising in India. While a substantial portion of the population struggles to get safe drinking water, a new generation, particularly in metropolitan areas, is becoming accustomed to paying high costs for bottled water. Over the last five years, the bottle water market has grown by 40-45 percent. Higher disposable income, increasing taste for hygiene, improved price, easier availability of packaged drinking water, and a lack of safe drinking water are driving demand for bottled water. While India is among the top ten bottled water users in the world, its per capita bottled water consumption is estimated to be five litres per year, which is far lower than the global average of 24 litres. Bottled water is becoming one of India’s fastest growing industries. Bottled water is now available in a range of sizes, including 200 mL pouches and glasses, 330 mL bottles, 500 mL bottles, one-liter bottles, and even 20- to 50-liter bulk water packs. In terms of price, the bottled water industry in India is classified into three categories: premium natural mineral water, natural mineral water, and packaged drinking water.

According to a national-level survey, India has over 200 bottled water brands, with roughly 80 percent of them being indigenous companies. In fact, bottled water production is becoming a cottage business in the country. COVID-19 Impact on India Bottled Water Market. The pandemic has delivered a significant hit to bottled water producers, who rely heavily on sales from workplaces, aeroplanes, and the HoReCa (hotels, restaurants, and catering) sector. Retail sales for the category have been terrible, despite the fact that tourism has just recently resumed. As a result, bottled water producers are seeking for new methods to approach customers directly.

The Bottled Water Market in India was valued at USD 2,970.61 Million in 2021, and it is estimated to reach USD 7897.20 Million by 2029, according to the Trade Promotion Council of India. However, because to the pandemic, this industry, 80 percent of which is unorganised, might face a de-growth of more than 30 percent. Bisleri, Aquafina, and Bailley are embracing the direct-to-consumer concept by developing their own online platforms or partnering with delivery applications. Bisleri, for example, has developed its own website and is now accepting orders for delivery via its customer service line. Bisleri International has delivery agreements with Zomato, Dunzo, Big Basket, and Amazon, and it has increased its physical presence in pharma and milk shops. Bailley, a subsidiary of Parle Agro, began supplying 20-liter jars via internet channels during the lockdown period and is now trying to “aggressively” expand.

India Bottled Water Market Overview

Factors increasing the growth of the market: The India bottled water market is one of the fastest growing industries in the country, with a billion-dollar business expected by the end of the decade if present development trends continue. Increased disposable income, a weak public water distribution system and infrastructure, and the Indian government’s lack of concern for the nation’s water resources are all factors leading to such rapid growth.

However, like with any company, the Indian bottled water industry has hurdles such as insufficient transportation infrastructure, low entry barriers, difficulty in brand identification, and occasionally threats from environmentalists and social activists opposing the usage of bottled water.

India is blessed with abundant natural water resources, but rising population, alarming rates of global warming, and rapid industrialization, combined with a lack of adequate and improved management of water supply systems, have resulted in increased water consumption, water waste, and deterioration of water supply networks, resulting in water scarcity. Water scarcity in India has created new opportunities for the bottled water industry in the present decade.

Direct-To-Consumer: Because of the pandemic, people are eager to obtain bottles straight from the firms. OwO Technologies, which lists Bailley, Bisleri, Aquafina, Kinley from Coca-Cola, and Divya Jal from Patanjali via its app, promises to service 500 orders every day in Gurugram. It intends to extend to other parts of Delhi-NCR in the near future. Most firms, such as Bisleri, Aquafina, and Bailley, will begin delivering water to residential areas in June 2020. OwO derives around 30% of its revenue from institutional sales and the remainder from consumer sales. Given the existing scenario, such collaborations allow businesses to get access to multi-story, huge residential societies. Because this industry is mainly unorganised, fake bottled water has been a difficulty. However, in the current scenario, consumers are even more cautious.

However, entering the direct-to-consumer approach will be difficult. The bottled water market has a relatively low gross margin of approximately 10%, compared to 50% for aerated beverages, and distributing directly to customers incurs additional costs due to the logistics required. This group will struggle to survive post-pandemic unless they modify their message and emphasise the health element as well as propositions such as extra minerals, nutrients, and so on. Companies must find out how to recruit clients, bring them to their website, and prepare for the expenses of last-mile delivery. According to industry analysts, this new avenue will not compensate for the total loss of revenue. Because this category is likewise based on impulse purchases, direct-to-consumer is a short-term metric. People will not buy bottled water if they do not leave their homes.

Challenges for companies and regulators: The most difficult obstacle for bottled water firms in India is duplication, particularly in the case of 1 L bottles. In comparison to any other product, making a phoney bottled water is really simple. Indian customers think that any bottled water is safe, although this may not be the case in the event of a forged product. Even such bogus items are made by filling a discarded pet water bottle with water and selling them exclusively in a few areas where the public travels the most, such as railway stations, bus stops, and metro stations. The bottles used to fill such items are discarded in dustbins, along roadsides, and at dump yards.

Other significant issues come from the unorganised sector, which dominates the manufacture of bottled water in rural, semi-urban, and metropolitan regions. Because the manufacture does not need large machinery, counterfeiters have been able to make bottled water in several places with a single licence and without a licence.

The most difficult problems in this unorganised industry are quality and safety. In 2017-18, food safety agencies lifted 1,123 samples across the country. 496 of these samples failed to fulfil the quality requirements set by the country’s top food regulator, the FSSAI.

In India, the bottled water market is regulated, and all bottling operations must get both BIS certification and an FSSAI licence before they can operate. However illegal manufacturing units do thrive across the country, putting at great risk the health of the people.

International Players to takeover Indian brands: Parle was the first Indian business to join the bottled water industry in India, releasing Bisleri 25 years ago. However, with the arrival of prominent global companies such as Coca-Cola, Pepsi, Nestle, and a noticeable presence of national players such as Mount Everest, Manikchand, and Kingfisher, that image is deteriorating. Their distribution network combined with a competent marketing technique resulted in them grabbing the majority of the bottled water industry, however they face stiff competition from regional businesses as well. The infrastructure and distribution network needs are the same for all sorts of players, whether they operate at the national or regional levels; nonetheless, they may differentiate themselves solely in terms of marketing and branding.

Almost all of the major international and national brand water bottles have made their way into the Indian market and can be found anywhere from malls to railway stations to bus stations to multiplexes to grocery shops and even panwala’s shop. It has permeated so thoroughly into the market that it is now fairly ordinary to consume bottled water, although just a few years ago, it was regarded the choice and trend of the wealthy. Because of the corporations’ aggressive marketing methods and low prices. According to certain research, truck drivers on highways account for a sizable proportion of bottled water users. Penetration in rural areas is another significant factor that is likely to play a key role in the development of the bottled water trade.

India Bottled Water Market Segment Analysis

Based on product, the market is segmented into flavoured water, purified water, mineral water, sparkling water, and others. The purified segment held the largest market share of more than 40.0% in 2021 and is estimated to maintain its dominance over the forecast period. Diseases like dysentery, diarrhoea, and typhoid are frequently caused by contaminated particles are present in the flowing water, due to which consumers are searching for water-saving measures, and businesses are tackling the same challenges. Aquafina, for example, provides purified drinking alternatives that are filtered and sodium-free.

The demand for mineral water in India is expected to be 500 million litres of pure water bottles each year, with the market expected to increase at a pace of 25-35 percent per year. The domestic mineral water market is mostly driven by the tourist industry. Furthermore, demand may come from the institutional sector as well as the upper income bracket group in cities. From 2022 to 2029, the sparkling sector is expected to increase at the fastest pace of 7.4 percent.

The industry is being driven by consumers’ increased desire for sparkling water as a healthier alternative to sugary drinks such as cola in order to reduce sugar content levels. Excess sugar in the body leads to weight gain/obesity, type 2 diabetes, and other health problems. According to Bevnet Magazine, the November-December 2020 sparkling category has nearly doubled from the previous year. This is due to the product’s health benefits, as well as a rising trend in customer preference toward healthy drinks. This is expected to be the segment’s primary driver.

Flavored bottled water has lately gained popularity in India. Flavored water containing fruit essence and artificial sweeteners, such as soda, cola, juice, and other sweetened beverages, are frequently used as a substitute for plain bottled water. Flavored bottled water is occasionally preferred above regular bottled water by consumers. This transition is creating an opportunity for bottled water firms in India to increase their product portfolio. Based on distribution channel, the market is segmented into off-trade and on-trade. The off-trade segment held the largest revenue share of 85.6% in 2021. The segment includes all retail outlets such as hypermarkets, supermarkets, convenience stores, mini markets, and traditional stores. The rising ease of swiftly selecting the desired brand of bottled water with a certain combination of minerals will drive market expansion through the forecast period. Aquafina, Bisleri, Himalayan, Bailley, and Kinley are among the brands carried in the off-trade segment. From 2022 to 2029, the on-trade channel is expected to grow at the fastest rate of 7.7 percent. Restaurants, cafés, clubs, hotels, and lounges are examples of establishments in this category. Growing health and hygiene concerns, along with an increase in COVID-19 instances, have driven consumers to purchase bottled water instead of the usual alternatives at such establishments. Furthermore, the establishment of clubs, bars, and outdoor activities at resorts and hotels is expected to promote bottled water consumption through this channel.

Despite the presence of a huge number of small and local manufacturers, this industry is controlled by multinational corporations such as Parle Bisleri, Coca-Cola, PepsiCo, Parle Agro, Nestle, Mount Everest, Kingfisher, and Manikchand, among others. While Bisleri mineral water remains the leading brand among national players, with a 40.02 percent market, Coca-Kinley Cola’s comes in second with a 28.3 percent share, followed by Aquafina at 19.1 percent. According to the article, other minor brands include Parle Agro’s Bailey, Kingfisher, and McDowell’s No. 1. These companies are the trend setters in the marketing of bottled drinking water. PepsiCo has announced plans to quadruple its investment in its Indian beverage division. The company’s investments in Indian beverages will now reach $220 million. Mount Everest Mineral Water, a Tata subsidiary, will also introduce a bottled water brand for the general market very soon. Currently, Mount Everest distributes exclusively premium drinking water under the Himalayan brand.

India Bottled Water Market Regional Insights

Bottled water use in India is connected to the amount of affluence in various regions. The western portion of India accounts for around 40% of the market, with over 300 indigenous and private enterprises manufacturing water pouches and bottles in the state of Gujarat. However, the bottling operations are concentrated in the Southern India. More than half of all bottling factories are located in four southern states. Citizens’ future is very bleak in the coming years unless water management practises are changed, and if no drastic steps are taken in this direction, then a severe water crisis will occur within the next two decades, leaving no money supply to build new infrastructure and also not being able to meet the increasing demand for water due to India’s population explosion.

According to a draft World Bank assessment, India’s demand for water would exceed all sources of supply in the future unless the country’s management policies are adjusted. India can still only store a little amount of its erratic rains. Whereas arid-rich nations (such as the United States and Australia) have built over 5,000 cubic metres of water storage per capita, and China can store over 1,000 cubic metres per capita, India’s dams can only store 200 cubic metres per person. Furthermore, India can only retain roughly 30 days of rainfall, compared to 900 days in major river basins in wealthy nations’ dry areas. This report presents a comprehensive analysis of the India Bottled Water Market to the stakeholders in the industry. The past and current status of the industry with the forecast market size and trends with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. The report also help in understanding the India Bottled Water Market dynamic, structure by analyzing the market segments and projecting the India Bottled Water Market size. Clear representation of competitive analysis of key players by segment type and regional presence in the India Bottled Water Market make the report investor’s guide.

India Bottled Water Market Scope

Projected Demand

India Bottled Water Market was valued at USD 2,970.61 Million in 2021, and it is expected to reach USD 7897.20 Million by 2029, exhibiting a CAGR of 13% during the forecast period (2022-2029).

The India Bottled Water Market, valued at USD 2,970.61 Million in 2021, is anticipated to reach USD 7,897.20 Million by 2029, exhibiting a CAGR of 13% during the forecast period. Market Overview: The bottled water market in India symbolizes a new lifestyle and increasing health-consciousness.

The total Indian packaged water market was (organised and unorganised) valued at over $2.43 billion (around Rs 19,315 crore) in 2021.

The market size of bottled water in urban India was estimated to be over 199 billion Indian rupees in 2023. In comparison, the rural areas accounted for over 90 billion Indian rupees in market size. The overall bottled water market was estimated to be over 289 billion Indian rupees during the same year.

The market is expected to grow annually by 7.46% (CAGR 2024-2028). In the Bottled Water market, at-home volume is expected to amount to 28.4bn L by 2028. The Bottled Water market is expected to show a volume growth of 3.4% in 2025. At-home revenue in the Bottled Water market amounts to US$53.5bn in 2024. The market is expected to grow annually by 5.00% (CAGR 2024-2028). In the Bottled Water market, at-home volume is expected to amount to 66.8bn L by 2028.

Cash Flow

The project entails an investment of Rs 11,52,11,000(Rs 11.52 crores) with an estimated sale of Rs 16,58, 88,000 (Rs 16.59 crores). The net profit for from the project is at Rs 5,06,77,000 (Rs 5.07 crores).

The liquidity position of the project can be seen from the project cash flows an, yielding high returns. The company will have healthy financial position with dues repayed. The analysis shows that the project will have positive cash flow throughout the anticipated life.

Profitability

According to the projected income statement, the project will start generating profit in the 1st year of operation. Important ratios such as profit to total sales, net profit to equity (Return one quality) and net profit plus interest on total investment (return on total investment) show an increasing trend during the lifetime of the project.

The income statement and the other indicators of profitability show that the project is viable.

Pay-Back Period

The investment cost and income statement projection are used to project the pay-back period. The project’s initial investment will be fully recovered at the 2 years of operation. The total capacity of the plant will be 21,600,000 liters per annum which shall be increased substantially in phases in keeping with the growing demand in Ayodhya.

The project will have significant contribution towards the development of social and economic aspects of the country. The proposed plant project will create employment opportunities for a number of skilled and semi-skilled workers and it is expected to generate employment opportunities for about 254 workers (134 permanent and 120 temporary workers).

GET EQUITY

₹ 100 PER SHARE