GET A PIECE OF TELECOM TOWER COMPANY

TELECOM TOWER COMPANY

CLARITY OF VOICE : CLARITY OF PICTURE

Towering Business that never stops wit geometrical growth in mobile telephony.

This Reg CF offering is made available through Private Equity Junction. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

REASONS TO INVEST

Cell Tower investments offer stable and consistent cash flow through long term basis with Telecom companies.

High demand due to increasing usage of mobile devices and wireless technology.

Telecom Tower market expected to increase at a CAGR of 5.71% between 2024 to 2031 from a valuation of US$ 69041.61 million by 2031. A share of Telecom Towers Company, a towering business that never stops with a geometrical growth in mobile telephony!!

Sector & IP Overview

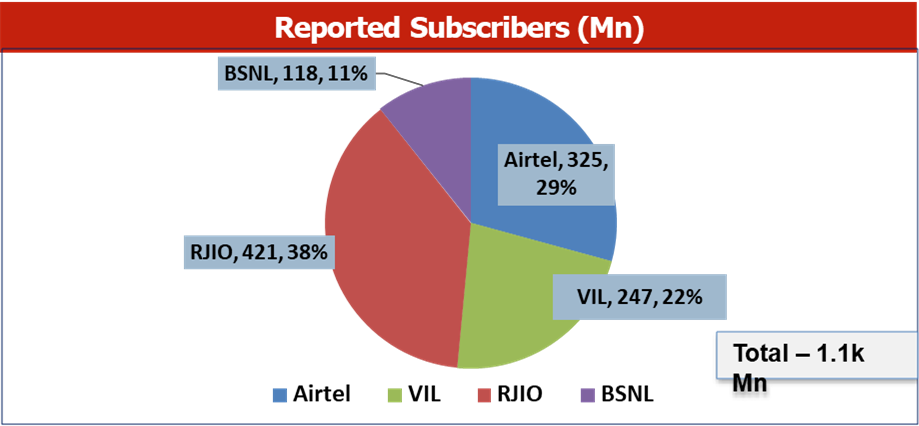

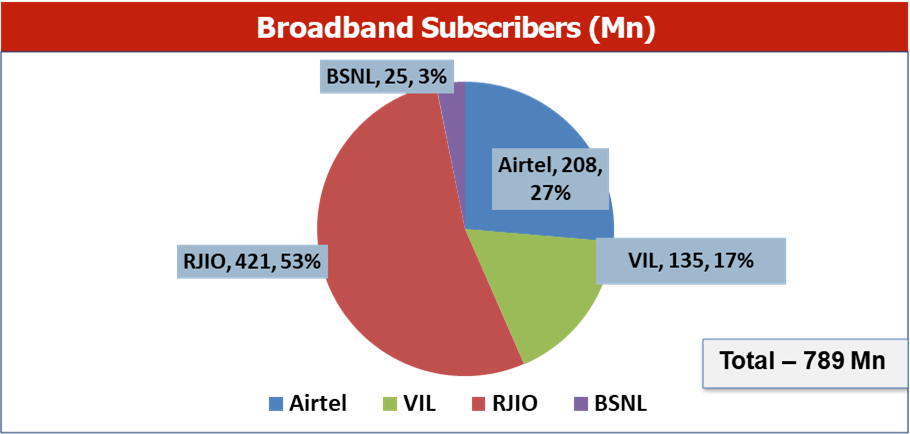

Telecom Market

- One of the largest telecom markets in the world – 1.1 billion subscribers,

- Jio & Airtel the two largest telecom operators ~ 67% of the subscriber base

- Fastest digital adoption with one of the highest per capita data consumption in the world – 240 giga bytes per user per annum; predicted 550 gigabytes per person p.a. by 2027 (as per Nokia annual mobile broadband index)

- Second largest online market in the world – 850 million have access*

- Overall Tele-density 85%* (Urban – 133%, Rural 58%) – creating a big opportunity to grow in rural areas

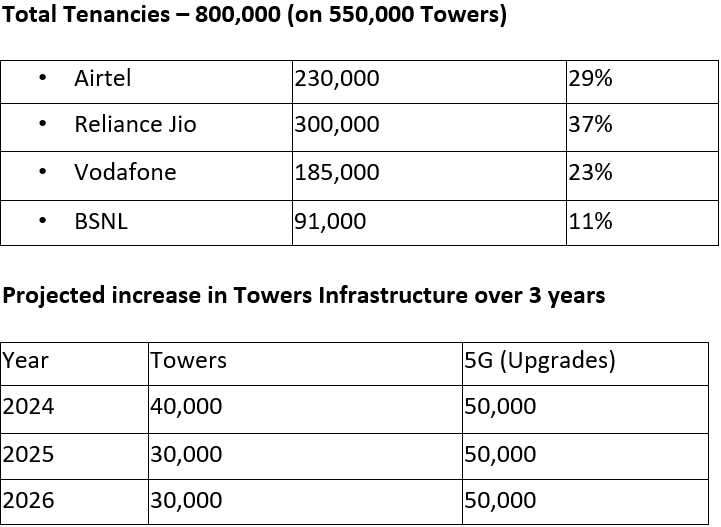

Towers Infrastructure

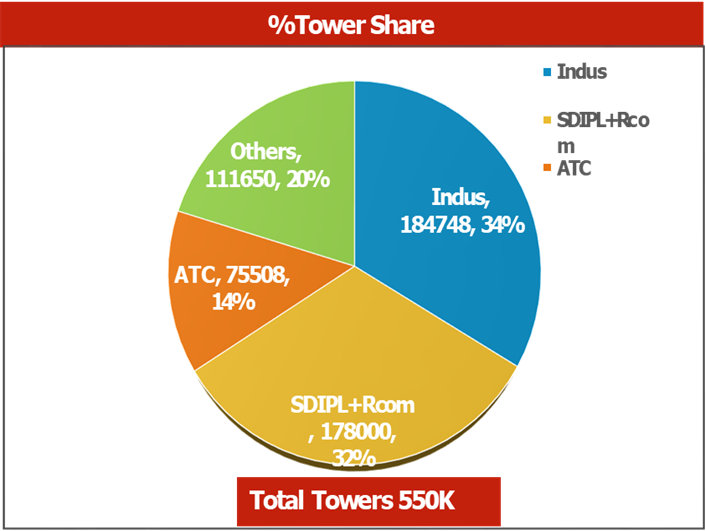

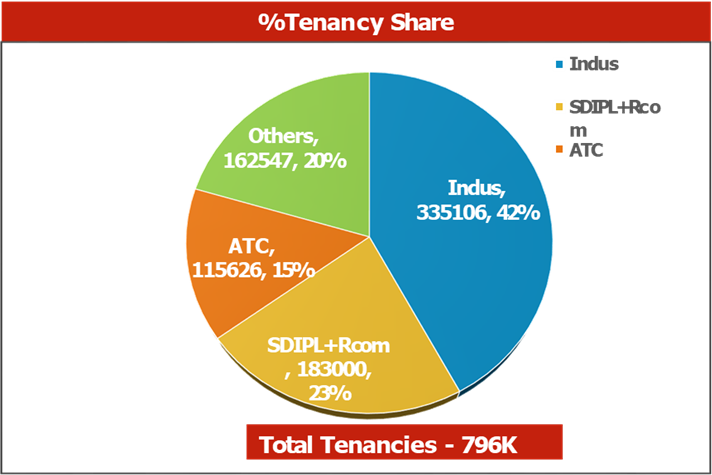

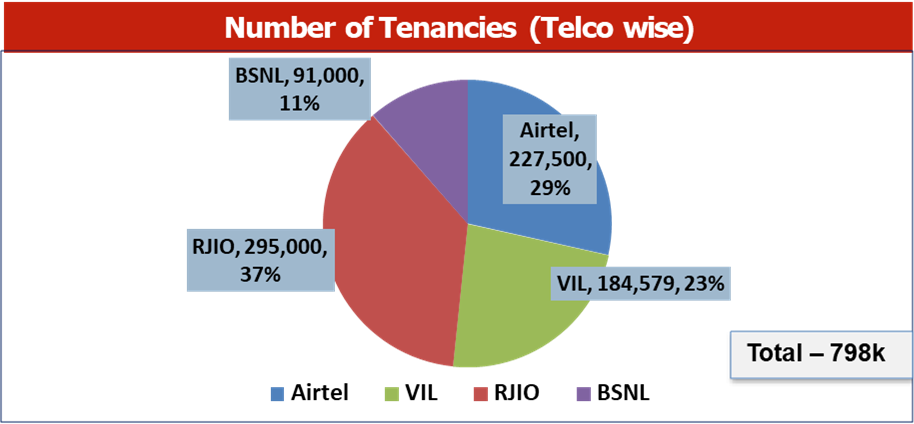

Towers & Tenancy Market Share

- Indus Tower & Tenancy share – 34% & 42% (TR – 1.81).

- ATC Tower & Tenancy share – 14% & 15% (TR – 1.53).

- SDIPL – 32% & 23% (TR – 1.03).

- Other IP’s (Ascend, TVI, GIL, BSNL) – 20% & 20% (TR – 1.46).

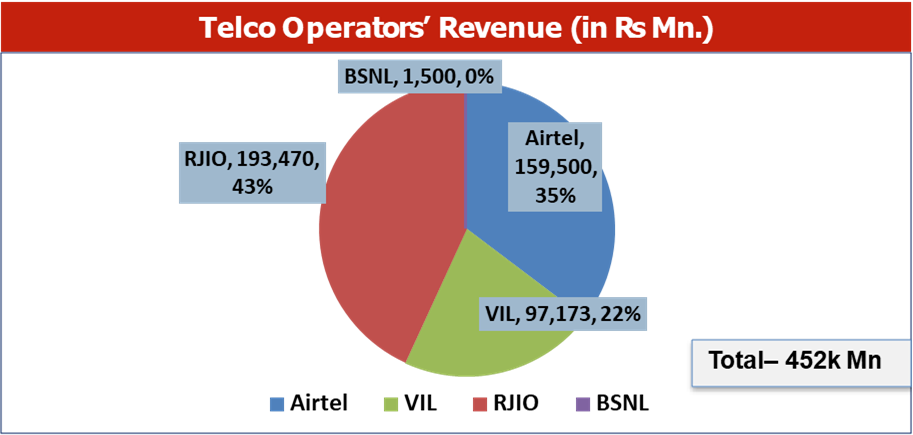

Operator Landscape

Key Takeaways

- SDIPL-Rcom – Capitive IP of Reliance Jio – single tenant sites

- SDIPL now 100% owned by Brookfield (bought in Sep-20)

- BSNL likely to roll out to

- independent IPs in 2024

- GTL – struggling – lowest TR

- ATC – planning exit

- Market offers a never-before

- opportunity to a new IP

The Opportunity

Current

Market State

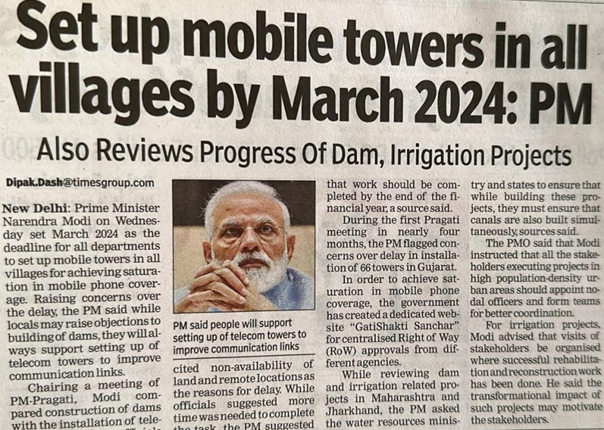

- Airtel expected to rollout 18k to 20k sites in 2023-24 – a big opportunity

- The 2nd largest (independent) Telecom Tower Infrastructure Provider currently exiting India market -– creating a void to be exploited

- Vodafone – dependency on funding, expected to catchup with rollouts by 2024-25

- BSNL received fresh influx of funds from Government; expected rollouts towards Q2 2024

- Towers to Consumers (broadband) market expanding exponentially

Proposed Solution

- Establish a new Infrastructure Provider company to exploit the void & capitalize at the industry growth

- Assembled the best team – rich experience of on-ground installations and management, excellent track record, strong relationships with Telecom providers

- Leverage close relationships with Airtel and other Telcos to secure initial MSA contracts to reduce cash burn

- Create a highly cost-efficient business model with focus on EBITDA margins and profitability

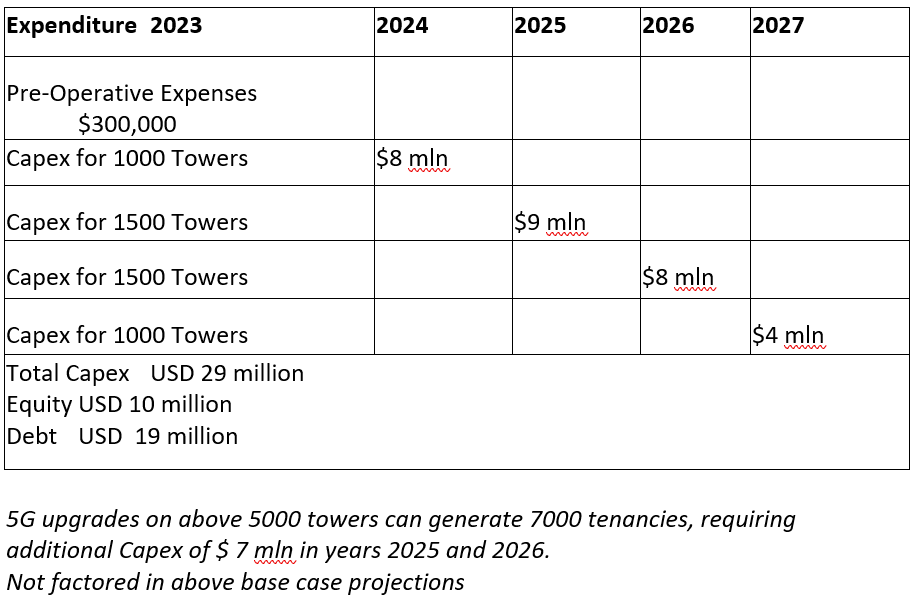

- Aim to create a company with a 5,000 towers multi-tenanted portfolio with diversified revenue streams by 2027

- Expected valuation in 2027 – INR 800 crores (USD 100 mln)

Team Track Record

Execution Team

- Collectively over five decades of professional experience.

- Wealth of expertise gained at renowned companies such as Motorola, Airtel, Reliance, Idea and ATC, spanning over 30 years

- Established track record of contributing to teams that achieved substantial business growth. At Motorola, played pivotal roles in increasing revenue from USD 40 million in 2005 to a staggering USD 600 million by 2007

- Expansion of tower sites, scaling from 0 in 2008 to an impressive 75,000 by 2016 at ATC.

- Their leadership is driven by a relentless commitment to operational excellence

- Adept at navigating the intricacies of building and managing IP-based businesses

- Sector experience of having invested in Towers business globally and managed them as PE Investors

Initial Phase

0 to 90 days

Company set-up, Onboard Management Team, Regulatory Licences, GST/IT Registrations, Set up Back-end , Legal & Compliance, MSAs from Telcos

Phase One

Day 91 to 180

Six Delhi, UP East, UP West, Greater Punjab , Rajasthan and Haryana

Phase Two

Day 180 to 270

Bihar/Jharkhand, Kolkatta & WB, Orissa and North East

Phase Three

Day 270 to 360

Karnataka, AP, TN , Kerala , MH & Mumbai

Phase Four

Day 360 to 450

MPCG, Gujarat

Tower Build Program

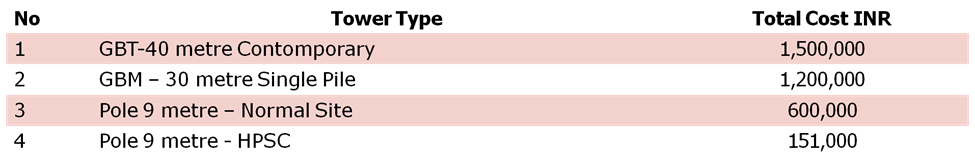

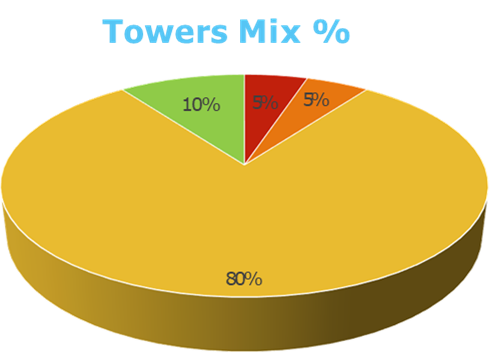

Weighted average cost per installation INR 6.5 lacs

Funding Requirement

Industry M&A activity

GET EQUITY

₹ 100 PER SHARE